Service Hotline

高峰:“帮别人就是帮自己”,遍历产业链之后,以投资赋能中国半导体

2022-04-02

12

Gao Feng holds a bachelor's degree in semiconductors from Tsinghua University and a master's degree in microelectronics from China Institute of Microelectronics. Since graduating 30 years ago, he has been working in the semiconductor industry. He has worked for Microelectronics Laboratory of Chinese Academy of Sciences, Chartered Semiconductor, TSMC America, PDF Solutions, Huahong NEC, Intergreen Chip. In 2017, I joined Shixi Capital for transformation investment. Capital partners. We are involved in more than 40 investment projects covering the entire semiconductor industry chain, from IP, EDA, materials to design, packaging and testing.

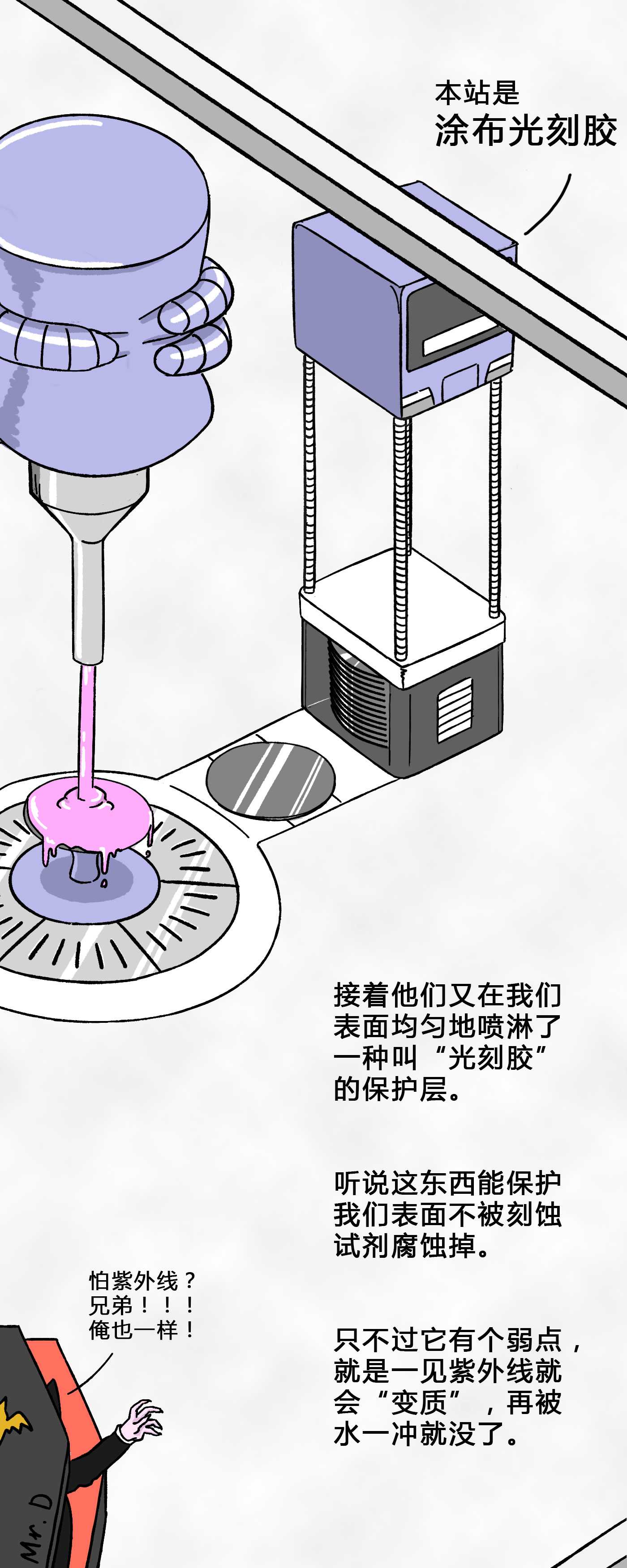

I am a sand, so I became a chip like this

2022-04-02

106

Disclaimer: This article is reproduced from the "Internet". This article only represents the author's personal views, not the views of Sacco Micro and the industry. It is only for reprinting and sharing to support the protection of intellectual property rights. Please indicate the original source and author when reprinting. If there is any infringement, please contact us to delete it.

IDM battle, chip company's "grandson and grandson three generations"

2022-03-29

174

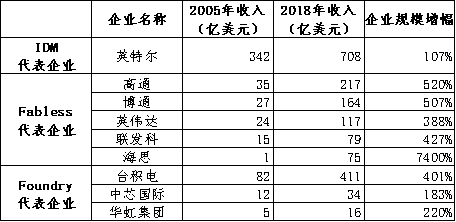

This paper is a reflection on the mode of chip enterprises after the author co-authored Core Road with Guo Qihang. It is divided into five parts, namely: (1) "Father and Son", talking about IDM and Foundry/Fabless. (2) "Grandpa is here today", talk about IDMP. (3) "Bully Dad", talking about IDM. (4) "Vibrant son" talks about Foundry/Fabless model. (4) "Chinese people all want to be fathers, but sons are the future", which is some personal views on domestic design enterprises' eagerness to do IDM on the production line or light IDM.一、Dad and sonDad. Before 1987, most of the integrated circuit industries in the world were in IDM mode, that is, the three processes of chip design, production and testing and packaging were completed within the enterprise. Intel, Samsung, Hynix and Micron are the representative enterprises of IDM. In addition to meeting their own needs, the chip production capacity of Intel IDM giants occasionally provided a small amount of chip processing and manufacturing services to the outside as a sideline. At that time, there was no professional OEM service in the market.Son. In 1987, with the deepening of industrialization of products and the increasing specialization of social division of labor, Foundry-Fabless model was derived from IDM model. TSMC in Taiwan Province founded the world's first pure OEM chip manufacturing enterprise, freeing chip design enterprises from capital-intensive and asset-intensive manufacturing business. Foundry's representative enterprises include TSMC, Grofeld, UTC, SMIC, Hua Hong Group, etc. Fabless is full of stars, such as Qualcomm, Broadcom, Nvidia, MediaTek, HiSilicon and so on.二、Grandpa is still alive.There is an old model, which was adopted by the early American IBM, the middle European powers and the recent Japanese giants. IDM only integrates design, manufacturing, packaging and testing. Compared with integrated circuit IDM companies like Intel in the United States, Japanese companies are not IDM companies in the strict sense. They go further than IDM, and the upstream and downstream are more closely tied. We might as well put Japanese semiconductor companiesThis model is calledIDMP,Here, P refers to Product, which is the model of grandfathers.。Until 1990' s, Japan's semiconductor business was almost all sub-departments under large groups, and its demand for semiconductor technology and chip products came from the group's own terminal products. This is completely different from the IDM enterprises like Intel in the United States, which are fully committed to meeting the most extensive technical and product requirements in the market. The former customer is its own parent company group, and its demand is stable, but it is easy to have irresistible fluctuations due to the fluctuations of the parent company group; The latter is the whole market, with huge space and a wide range of technical challenges, which is conducive to the improvement of the comprehensive performance of products. Japan's IDMP, in the early stage of semiconductor development, Japan gained a certain leading edge by virtue of its IDMP mode, especially the brilliant achievements of Japanese enterprises in the terminal markets such as small household appliances, which indirectly led to the rapid development of Japan's semiconductor industry, and once cultivated world-class electronic integrated groups such as Sony, NEC, Toshiba, Hitachi and Fujitsu.The disadvantages of IDMP are also obvious. First of all, the semiconductor departments of large groups have fixed sales direction and R&D direction, lack of competitive environment and weak motivation for technological innovation. Secondly, the semiconductor department is easily influenced by the terminal department of the group. If the terminal sales are good, the performance of the semiconductor department will be good, and vice versa. Japan once occupied most of the downstream applications of semiconductor industry, including TV, PC, radio, home appliances, etc. When the outlet is transferred to mobile intelligent terminals such as mobile phones and tablets, the terminal manufacturing in Japan is shrinking rapidly, resulting in the lack of Japanese companies among the top six mobile phone manufacturers in the world, which indirectly leads to the shrinking of Japanese semiconductor industry. The semiconductor sector, which is pampered in large groups, also lacks the motivation to innovate, and the benefits of the group are not good, so the R&D support for the semiconductor sector is correspondingly reduced. Coupled with the traditional lifelong employment system in Japan, young people aim to work in big factories for a lifetime. It's hard to see the spark of Silicon Valley-style semiconductor entrepreneurship in the United States outside big Japanese groups."IDMP mode" is not a national characteristic of Japan, and the semiconductor industry in Europe has a similar experience. Siemens in Germany and Philips in the Netherlands are both integrated electronic information groups, and their semiconductor divisions are very strong. In 1999, Siemens Group of Germany separated its semiconductor business and set up a new company, which is INFINEON of Germany, an IDM enterprise, which ranks second in the world of automotive electronic chips today. Philips Group of the Netherlands separated its semiconductor business in 2006 and set up a new company, which is NXP Company of the Netherlands, which ranks first in the world of automotive electronic chips today.三、A domineering father. There is a common view that design companies can do IDM on the production line when they have the conditions. The cost of opening a chip factory at the low end is USD 1 billion, and if you want to operate at the operation level of UTC or Grofond, the cost is USD 50 billion. The head of MediaTek in Taiwan Province once commented: "If an IDM company's turnover exceeds USD 5 billion, I believe they can still maintain their own fabs, but if it is a medium-sized factory under USD 2 billion or USD 3 billion, I'm afraid it must develop into a Fabless design company." This sentence can also be understood as, if the annual income of a pure chip design company reaches the level of $5 billion, then IDM mode can be considered in terms of economic strength.MediaTek's revenue in 2021 was as high as $17.4 billion, far exceeding its declared economic threshold of being able to build its own factory for IDM, and then did not make such a choice.今天Almost all IDMs were established before 1990.。30Over the years, since then, no large design company has transformed IDM.,Including Qualcomm (revenue 26.8 billion USD in 2021), Broadcom (revenue 18.7 billion USD in 2021), Nvidia (revenue 16.2 billion USD in 2021) and so on. As an established IDM company, AMD stripped off all its chip manufacturing sectors in 2015, that is, today's Grofeld Company of the United States, and withdrew from the IDM mode.Why do you say dad is domineering? Two reasons:First, being an IDM requires deep pockets. Its factory equipment not only has a high one-time investment, but also needs tens of billions of investment every 2-3 years, which is an extremely heavy capital expenditure burden. Even in the capital-rich United States, only Intel is lucky enough to lead the personal computer industry, which enables it to invest heavily in the development of logic technology, making it an unparalleled leader in this field, and relying on monopoly profits to continuously invest in factories. As for Micron, another IDM company in the United States, it is also because it is located in a relatively low-cost area in the United States (Idaho), which enables it to survive the low tide of semiconductors in the 1990s and early 2000s.Second, IDM enterprises have built extremely high wall barriers, and most of them are in a dominant position in the industry, whether it is Intel for CPU, Texas Instruments for analog chips, Samsung, Hynix and Micron for memory chips.四、Vibrant sonThe birth of Foundry-Fabless mode has greatly lowered the threshold of chip design. A few experienced chip engineers can set up a team to carry out chip design business, and then pay for chip foundry enterprises to process and produce, forming independent brand products. The income scale of Fabless enterprises is also rising, and they are competing with the traditional IDM giants. The professional people of Foundry manufacturers do professional things, concentrate on increasing R&D investment, improving capacity utilization, reducing costs, and making a lot of money. According to the statistical data from 2005 to 2018, the growth rate of Foundry and Fabless enterprises far exceeds that of Intel, the leading IDM enterprise in the same period.An interesting phenomenon is that Grofangde, spun off by AMD, has become the second largest Foundry in the world, and its operation performance has been unsatisfactory. It has suffered a net loss for many years, which is completely incomparable with the annual net profit rate of the largest TSMC, which exceeds 30%, and its benefits are even far worse than those of SMIC and Hua Hong Group, which are the fifth and sixth largest companies. This, in turn, shows that the chip manufacturing business under the original AMD IDM mode really has no professionalism and cost performance, and has no market competitiveness. Is it eroding the old capital of the design business?Dads are all moving towards the son mode.。Although my father is domineering, he sometimes feels guilty. Because dad needs to cover all aspects and take charge of all aspects of affairs, when competing with young people, he is often unable to do so in some aspects. In the practice of semiconductor industry, prominent dads are moving closer to the son mode.1. For example, AMD in the United States thinks about everything from side to side, and finds that the huge factory has affected its focused investment in design. It has split the factory, and the strong man's broken wrist can be brilliant again.2. For example, yesterday's Samsung Electronics has successfully cultivated the Foundry board from 100%IDM, and has become the second largest chip foundry company in the world after TSMC, and has set the goal of "making chip foundry the number one in the world by 2030".3. For example, yesterday's Texas Instruments, Infineon and NXP Renesas no longer insisted on 100%IDM, but threw the incremental demand of chip manufacturing to TSMC and other foundry companies.4. Today's Intel, for example, found that the upgrading of chip manufacturing technology has been lost to young TSMC, and is hesitating to learn AMD.五、Chinese people all want to be fathers, but sons are the future.Now we can see that TSMC, Qualcomm, Nvidia, Broadcom, etc. have chosen the youngest "Foundry/Fabless" model, which is full of vigor and vitality! Intel, Texas Instruments, NXP, Infineon, etc. have chosen to adhere to IDM mode, which is mature and steady! Only Japanese semiconductor companies all over the world have always adhered to the grandpa mode, and they are old and senile! It was not until mitsubishi electric Semiconductor Division, Hitachi Semiconductor Division and NEC Electronics had a difficult operation that they separated from their respective headquarters and reorganized into Renesas Electronics that Japanese semiconductors partially entered IDM mode from IDMP mode.China's practice is different.The common view is that China is facing the high-tech blockade of the United States and even the whole western world, and it will face the huge risk of overseas chip foundry companies refusing to contract for them. Therefore, it is necessary for design companies to transform IDM. Therefore, in recent years, Hangzhou Shilanwei, Wuxi Huarunwei, BYD Semiconductor, Gekewei, Wentai and Zhuoshengwei are all changing to IDM mode.The author believes that it is necessary for some pure chip design enterprises with economic strength to build factories to solve the capacity supply in the short term. From the actual situation, related enterprises focus more on non-advanced technologies such as simulation and power, which are really far from quenching thirst, and cannot be satisfied from professional foundries in a short time for two reasons. First, the OEM enterprises at the head are busy with the expansion of 12-inch advanced production capacity, and they don't have much energy on these non-advanced processes. Second, China's national conditions, local head OEM enterprises are far from the stage where TSMC has huge profits and can make self-recycling investment, so they are highly dependent on funds from national and local government industrial investment platforms. As we all know,No matter the state ministries or local governments, they are more inclined to make high, large and high-quality production lines and products, expecting breakthroughs rather than "low-level redundant construction". Therefore, although the head foundry enterprises recognize the profitability of non-advanced processes, it is difficult to get sufficient funds to complete 8 inches or even124 inches5Investment in the following nanometer production lines。However, in the long run, it depends on the cost performance and the market competitiveness of products. Will there be dozens or hundreds of semiconductor enterprises in China who are good at chip design, chip manufacturing and factory management? Obviously, no, after all, there is specialization in the industry, and it is not certain that you can achieve a beautiful goal with strong will. in additionSome domestic consumer electronics giants, automobile giants, communication giants, and power grid giants have gone out to do chip design in person. Although the integration of chip design, manufacturing, and end-user has not been formed yet, the chip design+end-customer model is taking the old way of Japanese IDMP's grandfather model after all. I don't think this is a long-term solution.。I think that in the next few years, IDM enterprises in China will be divided into three destinations:First, it's still an IDM enterprise, mostly in simulation and storage.Second, the manufacturing is stripped off and returned to pure chip design enterprises.Third, the transfer of control rights to the head foundry enterprises not only ensures the supply of the original production capacity, but also avoids distracting excessive energy on the manufacturing business that is not good at.The third mode is actually the direction that Sony Group of Japan is taking. Sony is the leader in the global CMOS image sensor industry and has always been an IDM enterprise; Considering that Sony CMOS image sensors were mainly sold to cameras, mobile phones, video cameras and other business divisions within the group, Sony was an IDMP enterprise at that time. Today, Sony chose to cooperate with TSMC to build a 12-inch advanced production line in Japan, which is specially used to meet Sony's production capacity demand, and the Japanese government has given huge subsidies accordingly.Disclaimer: This article is reproduced from the "Internet". This article only represents the author's personal views, not the views of Sacco Micro and the industry. It is only for reprinting and sharing to support the protection of intellectual property rights. Please indicate the original source and author when reprinting. If there is any infringement, please contact us to delete it.

PCB routing rules to avoid crosstalk

2022-03-08

165

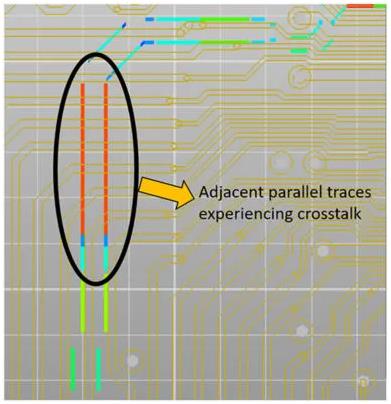

Today's electronics market requires the integration of multiple high-speed functions on miniaturized printed circuit boards (PCBS) on a single board, leading designers to place wiring very close together to optimize packaging and space. This proximity can lead to unexpected coupling of electromagnetic fields, a phenomenon known as Crosstalk (see Figure 1).

Present situation of semiconductor parts industry and suggestions for China's development

2022-03-08

193

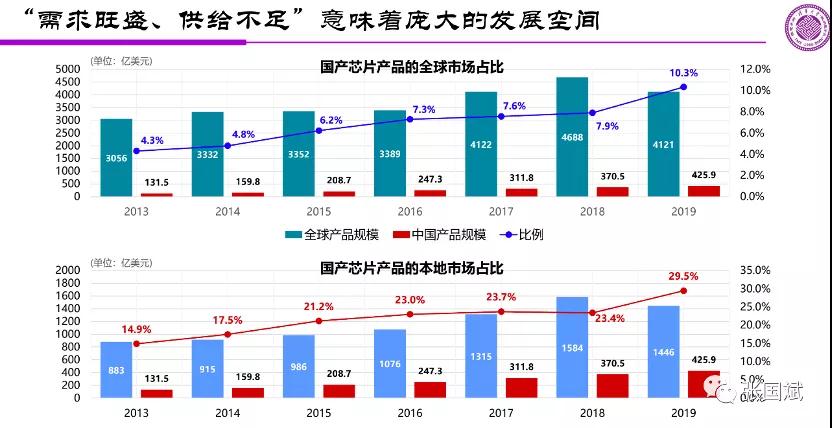

The semiconductor industry is the core supporting industry to build China's strategic scientific and technological strength, and the semiconductor parts are the key field to determine the high-quality development of China's semiconductor industry. Although China's semiconductor industry is in the stage of accelerating development, the domestic semiconductor parts industry is still facing many problems, such as low localization rate, insufficient long-term support and investment, weak independent innovation ability of enterprises, poor upstream and downstream cooperation of the industry, lack of talent training and incentive mechanism. This paper will comprehensively summarize the development characteristics and key enterprises of the global semiconductor parts industry, study the market size and development pattern at home and abroad, and put forward relevant development suggestions for the main problems facing the domestic semiconductor parts industry at present.

EDA software giant Synopsys Technologies

2022-03-08

235

(Nasdaq: SNPS) is a leading provider of electronic design automation (EDA) software tools for integrated circuit design worldwide. To provide advanced IC design and validation platform for the global electronics market, dedicated to the development of complex system on chip (SoC). Synopsys also provides intellectual property and design services that simplify the design process and speed products to market.

Easy introduction to Embedded Systems (1) - What is MicroPython?

2022-03-08

289

As Python became the dominant programming language, MicroPython became increasingly popular in the embedded systems space, especially in the popular ESP32 and the RP2040 microcontroller-based Pico module just released by the Raspberry PI Foundation.

The latest revenue ranking of foundries came out in the second quarter, with output of $24.407 billion

2022-03-08

135

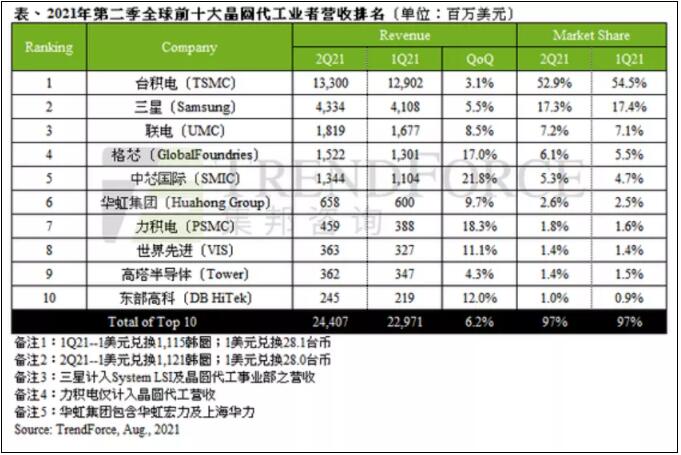

According to TrendForce, post-pandemic demand, communication generation shift, geopolitical risks and panic stocking caused by long-term shortages continued to spread in the second quarter, and driven by the continuous output of the first quarter's rising prices, foundry output reached $24.407 billion in the second quarter, up 6.2% since the third quarter of 2019. It has set new highs for eight consecutive quarters.

Hao Yue, academician of Chinese Academy of Sciences: the development of wide-band semiconductors can not only be used without innovation

2022-03-08

151

As IC transistor density gets closer to the physical limit, it becomes increasingly difficult to improve IC performance solely by improving the manufacturing process. Around how to develop the post-Moore era of IC industry, the world is actively looking for new technologies, new methods and new paths. In order to further promote the technological innovation and accelerate the industrial development of China's integrated circuits in the post-Moore era, China Semiconductor Industry Association and China Electronics News jointly launched a series of reports titled "Academicians talk about technology Evolution in the Post-Moore Era", which will interview academicians in related fields to discuss the development direction of the semiconductor industry in the post-Moore era.

How does Citigroup think of the safety of its semiconductor product supply chain (4: semiconductor production equipment)

2022-03-08

146

(Continued from Part I: Integrated Circuit Design, Part II: Integrated Circuit Manufacturing, Part III: Basic Packaging, Test, and Advanced Packaging)

5. Semiconductor product manufacturing equipment

(1) Outline of Semiconductor Manufacturing Equipment Small and Medium Enterprises

There are many types of semiconductor products processing and manufacturing equipment used by small and medium-sized enterprises in each process of the semiconductor production line. There are semiconductor-specific equipment (pre-processing) for manufacturing bare wafers (materials), equipment for processing bare wafers into final wafers (post-processing), and equipment for manufacturing photomasks (mask production). Chipmakers need a variety of front-end equipment on their production lines. The cost of complex front-end semiconductor fabrication equipment is a major reason for the high cost of semiconductor fabs, including the cost of building ultra-clean fabs.

Front-end semiconductor fabrication equipment includes equipment for chip fabrication processes such as photolithography, etching, doping or ion implantation, deposition, polishing, or chemical mechanical planarization. Of particular note are metal-organic chemical vapor deposition (MOCVD) equipment, a specific type of deposition equipment that deposits thin layers of certain metals, primarily used to produce compound semiconductors, including those based on GaAs and GaN.

Back-end semiconductor manufacturing equipment SME includes ATP and advanced packaging equipment.

(2) Current situation

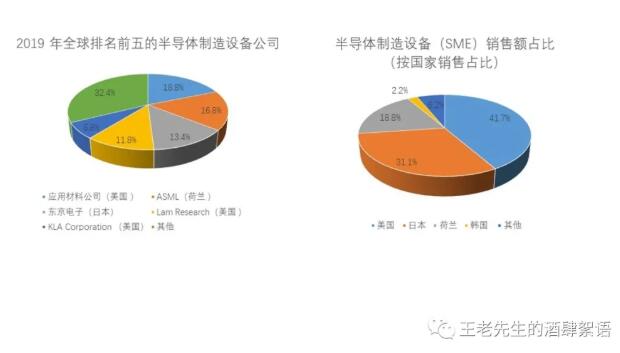

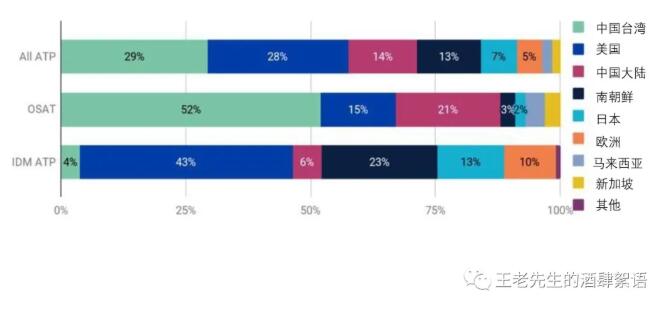

Semiconductor manufacturing equipment is dominated by companies in the US (41.7% share in terms of sales revenue), Japan (31.1%) and the Netherlands (18.8%). South Korea has a 2.2% share, with the remaining roughly 6.2% shared by China, Germany, Taiwan, Israel, Canada, and other countries in Southeast Asia and Europe. Most of South Korean semiconductor manufacturing equipment manufacturers are owned by Samsung or SK Hynix, the main customers of these South Korean semiconductor equipment companies are South Korean semiconductor companies. Although there is also a Chinese company that manufactures different types of semiconductor manufacturing equipment, Chinese companies do not have a significant share of any semiconductor manufacturing equipment category except back-end assembly, packaging equipment and MOCVD.

All in all, the US accounts for a large share of global production of most front-end semiconductor production equipment, with the exception of lithography equipment production that is concentrated in the Netherlands and Japan. The U.S. also accounts for a large share of global production of back-end test equipment. In contrast, the United States has a relatively small market share in the global back-end semiconductor production equipment manufacturing (assembly and packaging equipment), while China has a considerable share. While China is currently highly reliant on non-Chinese-sourced semiconductor production equipment (except for packaging and MOCVD), it is investing heavily to focus on producing such equipment. These investments give the beneficiary companies a significant advantage in developing and producing cutting-edge chip equipment relative to other companies.

As the chart below shows, while the U.S. has a sizable market share in the production of most front-end SMEs, the notable exception is lithography scan/stepper equipment, which is almost entirely made by Dutch company ASML and Japanese companies Nikon and Canon. For lithography machines, ASML (Netherlands) is the only producer of EUV steppers/scanners, which are critical for the production of integrated circuits with line widths of 5 nm or less. However, only two semiconductor makers, TSMC and Samsung, currently use EUV machines in production, with a single device costing more than $100 million. ASML and Nikon both manufacture deep ultraviolet (DUV) lithography machines that project a beam of light through a photomask and create a scaled-down image of the photomask pattern on the wafer. Outside of the Netherlands and Japan, the US and other countries' share of lithography equipment is mainly for specific low-volume chips or for making photomasks.

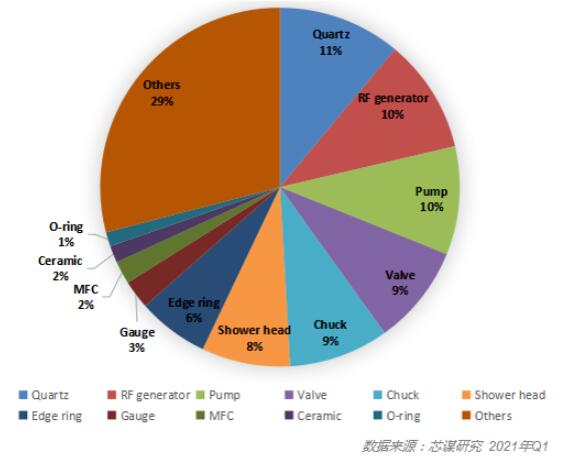

A set of semiconductor manufacturing equipment can have as many as 100+ parts, and semiconductor manufacturing equipment parts and accessories are the largest trade category in the industry. According to the Manufacturers Census survey, half of U.S. semiconductor manufacturing equipment sales revenue goes to components and other materials. More than 130 U.S. companies supply critical components for equipment sold by foreign companies. Notably, Cymer (USA) manufactures lasers for ASML's EUV stepper/scanner lithography machines. ASML acquired Cymer in 2013, but Cymer remains an independent US-based operating unit of ASML.

Because of the cyclical nature of sales due to limited markets and customers, most large equipment companies manufacture more than one type of equipment in order to provide customers with a full suite of equipment and maintenance options. Lithography stepper/scanner equipment companies such as ASML are exceptions to this rule due to the unique technology of the equipment. Lam Research, Tokyo Electron (TEL) focus on deposition and etching, while KLA focuses on metrology and inspection.

One exception to the lead in Japan and the Netherlands is MOCVD equipment, which is used to produce semiconductors made from materials other than silicon such as GaN and GaAs, including LEDs, laser diodes and other photonic chips, power/RF devices and solar cells. As mentioned above, GaN chips have strategic defensive implications. MOCVD equipment is manufactured by Veeco (USA), Aixtron (Germany) and AMEC (China). China is trying to gain market share in the MOCVD market through acquisitions. In 2016, the Chinese entity Fujian Grand Chip Investment Fund, a company formed for the deal, including state- and regionally-owned institutions, attempted to acquire Aixtron, but the deal was blocked by President Obama after a review by the Committee on Foreign Investment in the United States (CFIUS), potentially of the acquirer abandoned the takeover offer.

The top three companies for etching equipment are Lam Research (US), Tokyo Electron (Japan), and Applied Materials (US). Chinese companies, including AMEC, have some expertise in etching and can provide equipment for low-end applications, however, their market share is only around 1%.

The U.S. has a relatively small market share (4.9%) in back-end packaging SMEs compared to front-end semiconductor manufacturing equipment. Japan has the largest share of packaging equipment (35.7%), followed by China (22.9%) and the Netherlands (11.1%). However, US-based Kulicke and Soffa is a leading semiconductor packaging equipment company. The U.S. and Japan lead the way in back-end test equipment (ATP) with 33.5% and 48.6% market share, respectively.

(3) Semiconductor manufacturing equipment, the risk of the United States

Reliance on foreign (non-U.S.) sales:

While the U.S. has a large share of the semiconductor production equipment market, U.S. producers are highly dependent on foreign sales. As the largest semiconductor manufacturers, Taiwan, China and South Korea are the largest markets for semiconductor production equipment. Although Taiwan is expected to regain its position as the largest market for semiconductor production equipment in 2021 and 2022, due to the heavy spending required by chip fabs, Applied Materials and Lam Research report that about 90% of its total 2020 revenue will come from non- US sales. Lam Research's revenue from China increased from 16% in 2018 to 31% in 2020. As a result, U.S. semiconductor production equipment makers are at risk of being significantly impacted by U.S.-China trade restrictions or unexpected demand changes in Asia. The resulting impact could go well beyond the current revenue decline, as semiconductor manufacturers experience a degree of device lock-in, and changing device suppliers requires costly redesigns. For example, Lam Research noted in its 2020 annual report, "Once a semiconductor manufacturer commits to purchasing a competitor's semiconductor manufacturing equipment, the manufacturer typically continues to purchase that competitor's equipment, making it harder for us to sell us to that customer in the future. equipment.” In addition, sales of semiconductor production equipment are limited to universities and semiconductor manufacturing companies that own fabs. Semiconductor production equipment companies cannot grow their customer base outside of these categories because such equipment is unique to the semiconductor industry.

Chinese subsidies for the production of semiconductor manufacturing equipment distort the market:

In addition, China plans to provide substantial subsidies to finance the production of semiconductor production equipment in the country. The second phase of the China National Integrated Circuit Industry Investment Fund focuses on etching machines, deposition equipment, testing and wafer cleaning equipment, with funding ranging from $28.9 to $47 billion. The subsidies keep Chinese companies in business, even though most appear to be unprofitable. For example, according to the Organisation for Economic Co-operation and Development (OECD), “government capital injections have had a clear impact on the financial performance of Chinese semiconductor producers,” where increases in corporate assets have not been matched by growth in profitability. These subsidies provide Chinese companies with funds to invest in research and development in next-generation semiconductor manufacturing, giving them a significant advantage over non-Chinese companies that do not receive such subsidies. Unlike in the past, semiconductor production equipment manufacturers today are reluctant to invest in R&D for next-generation wafer sizes, given the substantial R&D and capital expenditures to manufacture semiconductor production equipment and the uncertainty of when and where leading-edge chip production will be made.

How Citigroup views the security of its semiconductor supply chain (II: INTEGRATED Circuit Manufacturing)

2022-03-08

144

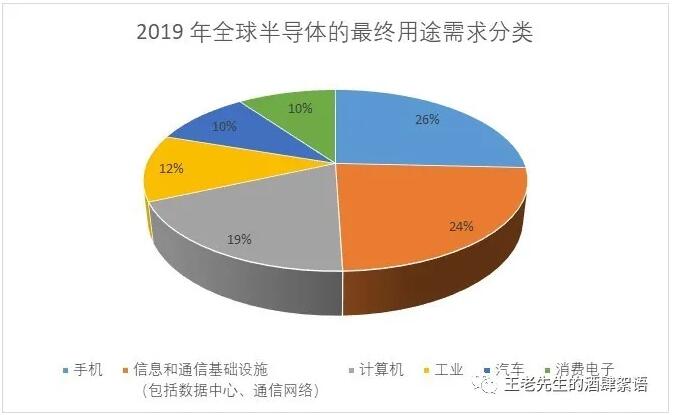

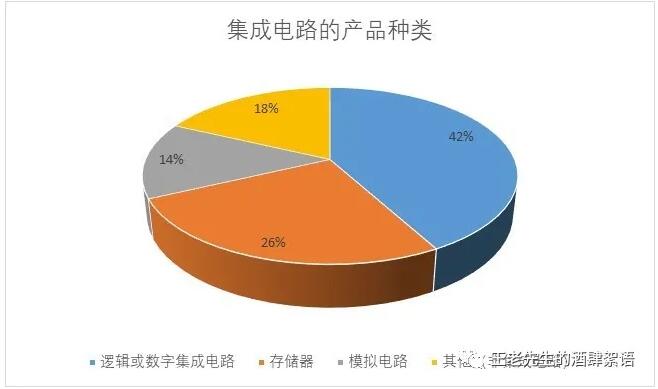

(Follow part I above: Integrated Circuit Design (About INTEGRATED Circuit Manufacturing (1) Citigroup's Basic Estimate of the Integrated Circuit Manufacturing Industry Semiconductor products drive nearly every sector of the economy, including energy, healthcare, agriculture, consumer electronics, manufacturing, and transportation. Global end-use demand for semiconductors in 2019 is: mobile phones (26%), information and communication infrastructure (including data centers, communication networks) (24%); Computers (19%), industry (12%), automotive (10%) and consumer electronics (10%). About 9% of these different applications directly support national security and critical

How Citigroup views the security of its semiconductor supply chain

2022-03-08

27

(Following part I: Integrated circuit design; ATP (Assembly, Test, andPackaging) and advanced packaging (1) For the relatively low-tech back-end semiconductor ATP, the United States relies heavily on foreign resources concentrated in Asia. (2) As chips become more complex, advanced packaging methods represent potential areas for significant technological progress. However, the US is also not a cost-effective place to develop a strong advanced packaging industry because it lacks the necessary materials ecosystem; (3) Corresponding to this,

How does Citigroup think of the safety of its semiconductor product supply chain (one: integrated circuit design enterprise)

2022-03-08

136

Risks, solve loopholes and formulate a strategy of supplying chain toughness.

When can Chinese semiconductor catch up with the world level? Chen Datong's answer is ...

2022-03-08

169

"How many years can China's semiconductor be caught up with the world level? The answer I gave two years ago is that the package has basically caught up with the world level. The design takes 5 to 10 years. The memory takes 10-15 years. The equipment/materials take 10-20 years, and the high threshold will be relatively slow. "Picture: Chen Datong, a partner of Puhua Capital, not long before, Chen Datong came to the Sand Dune Academy to share his semiconductor entrepreneurship and investment perception in the past thirty years. This article is sharing of desensitization content: Can you make money to invest in China's semiconductor industry? I attended the Qingke Annual Conference in 2009. At the annual meeting, some people said that all industries in China can make money, except semiconductors. I did semiconductors for a lifetime, and I was stimulated at the time

Integrated circuit is the foundation of the information industry, the food of the industrial industry, and the foundation of security

2022-03-08

170

"Integrated circuits or chips are industrial food"

One of the source of the neck of Chinese semiconductor card -device parts

2022-03-08

146

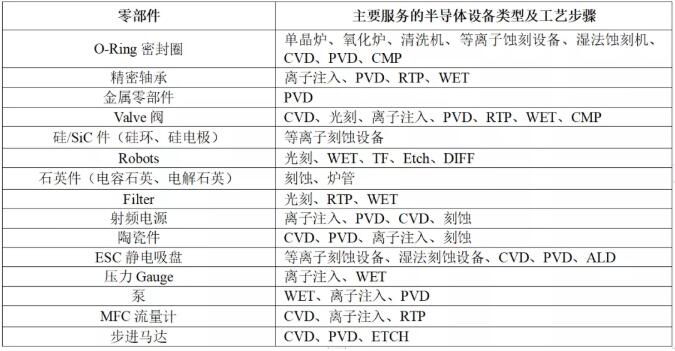

Pursuing the security and complete local ecosystem of the supply chain of China's electronic information industry is a gradual difficult process. The initial level was the independent development and production of chips, and then the demand for domestic equipment was derived. But the facts show that even the equipment can be made enough. The United States sanction Chinese wafer manufacturing enterprises, and some Chinese equipment manufacturers have to submit to the United States. The root cause is still relying on the United States on key components. Compared with the equipment, parts are not large in terms of equipment, but they are indeed typical.

Just! Huiting officials: Ms. Hu Yuhua serves as the president of Huiding Science and Technology!

2022-03-08

14

On February 23, after the industry simulation giant Texas Instrument (TI) announced the appointment of Jiang Han as the vice president of Texas Instrument Company and President of China, the former vice president of Texas Instrument and Ms. Hu Yuhua (Sandy Hu) became the industry. Focus, because 2020 is a year when TI's record revenue is a record revenue, Ms. Hu Yuhua chose to retreat and said that she would challenge herself again. How can she challenge herself?

40 domestic sensor chip manufacturers survey statistics report

2022-03-08

120

In electronics and electrical equipment, the sensor is used to obtain the original physical signal of the outside world, including sound, image, temperature, humidity, pressure, and light signals, and convert these physical signals into electrical signals, typical forms of voltage/current. Traditional physical and chemical sensors only obtain external signals and do not have the ability to calculate and process. With the improvement of manufacturing technology, size and cost requirements, MEMS sensors based on Microelectronics System (MEMS) process are becoming more and more popular. In the wide application of sensors, the smartphone is worthy of paying special attention. Whether the CMOS image sensor (CIS) or the touch/fingerprint recognition chip manufacturer has obtained huge development opportunities from it. Discipline

MCU localization -the righteousness of the world is vicissitudes

2022-03-08

122

China's semiconductor industry has been very hot. On the one hand, it is due to policy support, and on the other hand, it is also the natural fermentation of supply and demand market demand, which has accelerated the flowering of domestic semiconductors in various fields. Recently, Professor Wei Shaojun, director of the Institute of Microelectronics of Tsinghua University and vice-chairman of the China Semiconductor Industry Association, gave a speech at the Global CEO Double Summit "The right way is the vicissitudes of life, on strategic determination under the great changes", pointing out that the current domestic The development of semiconductors should return to the product-centered thinking, and re-examine the five major sectors of the semiconductor industry: design, manufacturing, packaging and testing, assembly and materials. We must respect the laws of industrial development, balance resources, and balance development. style development.

From the perspective of commonly used MCU single-chip products, there are a large number of development teams and supporting systems in China from consumer products around mobile phones, small home appliances to industrial motor control, automotive electronics, wireless communications, Internet of Things, and even artificial intelligence. At the same time, China also has the most extensive consumer groups and application scenarios. Based on the above factors, the development advantages of single-chip microcomputers in China are more obvious, and many local single-chip star enterprises have also been created!

Although the Chinese market is constantly expanding, there is still a big gap between domestic MCUs in terms of product form, market share and technological advancement compared to overseas brands.

In 2020, it is expected that the sales of domestic MCU manufacturers will reach 14.8 billion yuan, accounting for 55% of the entire Chinese MCU market. At present, domestic MCU manufacturers mainly compete in low-end applications such as consumer electronics, smart cards and water, electricity and gas meters, but in areas with large market potential and relatively high profits, such as industrial control, automotive electronics and the Internet of Things market, they are still dominated by foreign MCUs. Monopoly by manufacturers!

The Asia-Pacific Y2019 MCU performance rankings are as follows:

From the perspective of the global MCU market share in 2020, 32-bit MCUs will account for 62%, 16-bit 23%, and 4/8-bit 15%; from the perspective of the domestic MCU application market, 8-bit MCUs are still used as the market share. Lord, but with the continuous upgrading of terminal products, accompanied by the strong demand for computing power and low power consumption in the Internet of Things era, and the average selling price of the two is gradually narrowing the gap, 32-bit MCUs will surely usher in explosive growth!

The following is the basic information and statistical distribution map of 30 domestic MCU manufacturers compiled by Electronic Engineering Album in August 2020

Listed companies: 12, including 2 listed on the New Third Board and 3 subsidiaries of listed companies

Headquarters: 10 in Shanghai, 7 in Shenzhen, 3 in Beijing, 3 in Zhuhai, 2 in Suzhou, 1 each in Qingdao, Nanjing, Hangzhou, Chongqing and Anhui Wuhu

From the perspective of the kernel architecture, the Arm architecture is still the mainstream, accounting for more than 55%. However, with the deepening of policy support and market advancement, the proportion of RISC-V has also shown an upward trend.

We have collected and sorted out the comparison of some typical domestic MCU manufacturers. From this, we can also see the long-term layout of each manufacturer in different industries such as consumer electronics, Internet of Things, new infrastructure and automotive electronics based on their own technology and market advantages.

As early as April 2013, Zhaoyi Innovation launched the first 32-bit MCU based on the Arm Cortex-M3 core in China. After nearly 7 years of continuous development, Zhaoyi has 24 complete product lines on Arm core-based MCU products, with more than 300 optional models, featuring high performance, compatibility between series, and industrial reliability. performance and ease of development. According to official data, as of May 2017, Zhaoyi's 32-bit MCU shipments have exceeded 100 million units, and as of June 2020, this number has exceeded 400 million units.

In August 2019, Zhaoyi also launched the world's first general-purpose MCU based on RISC-V core: GD32V series. The first batch of new products provides 14 models, including 4 package types including QFN36, LQFP48, LQFP64 and LQFP100. And completely maintain the compatibility with existing products in software development and pin packaging. The performance of GD32V series MCUs at the highest frequency can reach 153 DMIPS, and the CoreMark test also achieved an excellent performance of 360 points. Compared with the GD32F103 with the GD32 Cortex-M3 core, the performance is improved by 15%, and the dynamic power consumption is reduced by 50%. , the standby power consumption is reduced by 25%.

In the future, the follow-up market products of GD32 MCU will develop in three areas: wireless connectivity, ultra-low power consumption and automotive-grade products.

无线连接

Y2020

● IOT WiFi

● BT+BLES.x+WiFi多模

● Sub 1GHz多模

● UWB

超低功耗

Y2021

● 电池供电设备

● 便携式设备

● 可穿戴设备

汽车级产品

Y2022

● 汽车级产品认证

● 车身控制系统

● 辅助驾驶系统

Chipsea Technology

Stock code 688595

Chipsea's current products are mainly for 4 fields: 1) Health measurement and medical products; 2) Human-computer interaction products; 3) Electrical signal measurement, power management and control products; 4) Smart home sensor products. Chipsea started with ADC, has been deeply involved in the ADC field for 17 years, and has accumulated 12 years in the MCU field. Its core innovation in the future will still focus on the ADC+MCU dual platform, providing various low power consumption, small size, high precision and high precision for the Internet of Things. High-performance signal chain products!

Smart Microelectronics

Since its establishment in March 2011, Smart Microelectronics has successfully completed the design and promotion of hundreds of MCU products. Currently, Smart Microelectronics has mass-supplied MCU products based on ARM Cortex-M0 and Cortex-M3 cores, including: The MM32F series for the high-performance market, the MM32L series for ultra-low power consumption and security applications, the MM32W series with multiple wireless connection functions, the MM32SPIN series for motor drive and control, and the OTP type MM32P series, etc. Market demand for rich application scenarios in multiple fields and at multiple levels.

In addition to paying attention to the traditional consumer electronics market, Smart Microelectronics also continues to strengthen its investment in the motor control market. You can refer to Smart Micro Marketing Director: Mr. Huang Zhikai, who shared at the 15th Shenzhen Motor Technology Seminar in 2020: http://news .ifeng.com/c/7ysBnANAD39, detailed answers to key issues such as mainstream motor control solutions and motor energy consumption.

Hangshun chip

Hangshun chip was established in Shenzhen in 2014. Its software and hardware are fully compatible with imported MCUs. As one of its major advantages, Hangshun provides low-cost MCU products that can enter the market fastest. The recently launched HK32F030M, a 32-bit MCU, has a price of less than 1 yuan for end users, and finally realized one of the most difficult breakthroughs for 32-bit computers to replace mid-to-high-end 8-bit/16-bit MCUs! HK32F030M is not only low in price, but also has 48M main frequency, 100,000 erasing times, etc. It can be widely used in oximeters, motors, ceiling fan lights, air conditioner refrigerator controllers and other products!

In the future, Hangshun chips will not only make efforts in the field of general-purpose MCUs, but also focus on market hotspots such as the country's new infrastructure and 5G big data for the Internet of Things, etc., and successively launch new products in the high-end and dedicated SOC fields.

BYD Semiconductor

BYD Semiconductor Co., Ltd., formerly known as Shenzhen BYD Microelectronics Co., Ltd., was established in 2004. At present, BYD Semiconductor's main business covers the R&D, production and sales of power semiconductors, intelligent control ICs, intelligent sensors and optoelectronic semiconductors. BYD Semiconductor believes that MCU chips, as the core of internal computing and processing in automotive electronic systems, are the key to the in-depth development of vehicles from electrification to intelligence. With its precipitation in the automotive industry, BYD Semiconductor entered the MCU field in 2007. Starting from industrial-grade MCUs, it adhered to the dual route of performance and reliability, and now has industrial-grade general-purpose MCU chips, industrial-grade three-in-one MCU chips, and automotive-grade MCU chips. 8-bit MCU chip of regulatory grade, 32-bit MCU chip of automotive grade and battery management MCU chip and other products. Up to now, BYD Semiconductor's automotive-grade MCUs have exceeded 5 million, and the cumulative shipment of MCUs exceeds 2 billion, achieving a major breakthrough in the market for domestic MCUs.

China is the world's largest automobile production and sales country, and also has the world's largest automotive MCU market. At present, about 100 MCUs are used in an average car. According to this estimate, the total amount of my country's automotive MCU market is about 2 billion, and the market size is as high as tens of billions of yuan. The rise of the new four modernizations of automobiles (electrification, intelligence, networking, and sharing) will further increase the demand for MCUs.

In addition to the comprehensive strength of benchmarking price, product performance, technical services, and logistics response with overseas brands, the editor believes that domestic semiconductors need to continue to strengthen the construction and content of the ecosystem. Taking STM32 as an example, ST provides a complete ecosystem of hardware and software development tools for each series of products, and builds a seamless development process with a one-stop development platform from configuration, development, programming to tracking, see below picture.

At the same time, ST has also cultivated a large number of potential user groups through multi-level resource support such as China University Program, online platforms such as official website/official micro, and online training.

In addition, ST also facilitates the creativity of partners through the partner program, making it easier for customers to access more development resources. Chuangxin Workshop is one of the ecological partners, providing firmware encryption and secure burning products and services for everyone. Third-party partners not only provide hardware resources such as hardware development boards, debuggers, and burners, but also provide program firmware services (firmware encryption, firmware security burning, firmware cloud burning, etc.) win-win.

"The right way in the world is the vicissitudes of life" comes from "Seven Laws - The People's Liberation Army Occupies Nanjing" written by Mao Zedong in 1949. He was in a good mood when he heard the good news that the People's Liberation Army occupied Nanjing on April 23 at the Shuangqing Villa in Xiangshan, Peiping, and wrote this poem.

The original text is as follows:

The wind and rain in Zhongshan turned yellow, and millions of heroes crossed the river.

The tiger and the dragon are better than the past, and the world is turned upside down and generous.

It is advisable to use the remaining brave to chase the poor bandits, and not to be called the overlord of learning.

If the sky is in love, the sky is also old, and the right path in the world is vicissitudes.

Things are constantly developing, updating and changing, this is an inevitable law! China is sitting on the world's largest consumer market, has natural market application advantages, and has excellent industry practitioners. Based on this, the domestic MCU industry still needs a long way to go. It should not be rushed, and it should not blindly consider corners. Overtaking and taking shortcuts, you have to take the "right way", and you will get the right result!

Note: This article is reproduced from the Internet to support the protection of intellectual property rights. Please indicate the original source and author of the reprint. If there is any infringement, please contact us to delete it.

Who will reconstruct the new order of electronic distribution?

2022-03-08

163

Traditional industries are like climbing, and the mountains are there. If you persevere and persevere, you may climb to the top of the mountain. The Internet is a bit like surfing. If you hit a wave, you caught up with it.

粤公网安备44030002007346号

粤公网安备44030002007346号